Home » How Its Works

Take the First Step Toward Financial Control

A fast, easy, and secure way to get the loan you need. With personalized support and quick approvals, your financial future is just a few steps away!

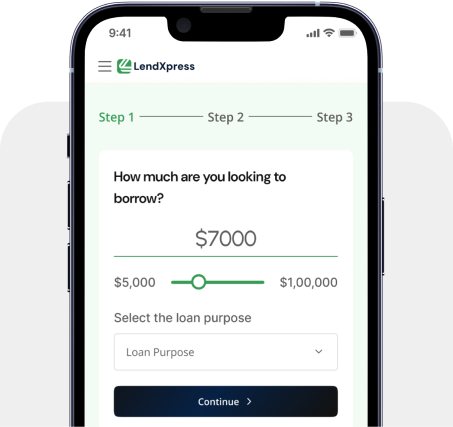

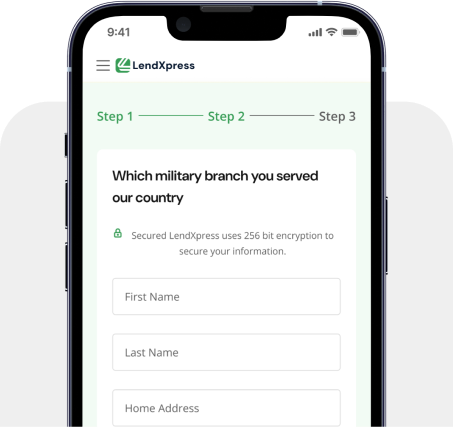

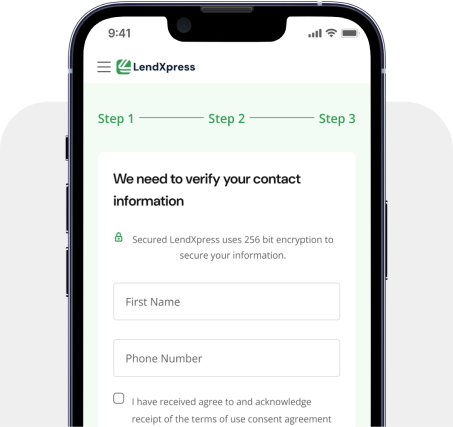

Quick and Secure Application

Complete a simple, secure online form with your basic information. Choose the most convenient time for our loan specialists to contact you. Rest easy knowing your personal data is fully protected every step of the way.

Customized Financial Guidance

Connect with a loan expert to explore the best options tailored to your financial goals. We’ll provide personalized advice on terms and rates that suit your situation. Once you’re pre-qualified, we’ll move your application forward with confidence.

Fast Approval, Funds in Hand

Get a fast approval decision and, if approved, have your funds deposited directly into your account. With 99% of funds transferred within one business day, you’re on your way to financial freedom without the wait.

WHY US

Why Choose LendXpress for Your Financial Needs

Discover the freedom and flexibility of LendXpress loans, designed to help you take charge of your financial journey.

Customer-First Approach

We prioritize your needs, offering customized loan options that align with your unique financial goals. Our team is dedicated to finding the best solutions for you.

Clear and Transparent Terms

Transparency is at the heart of what we do—no hidden fees or confusing terms. We make sure every detail is clear, so you can borrow with confidence.

Competitive Interest Rates

Benefit from some of the most competitive rates in the market, giving you more savings over the life of your loan.

Fast and Simple Application

Our easy-to-use online application makes getting a loan quick and hassle-free. Receive fast decisions, so you can move forward with your plans sooner.

Dedicated Customer Support

Our friendly team is with you at every step, providing expert guidance and top-tier support whenever you need it.

Top-Rated Service

We’re proud to be trusted by our customers. Your satisfaction is what drives us to keep delivering exceptional service.

Customer-Focused Approach

We put our customers first, tailoring loan options to meet unique financial needs. Our team works hard to give best solutions.

Clear and Transparent Process

We believe in complete transparency no hidden fees. Our loan terms and conditions are clearly explained.

Competitive Interest Rates:

Our loans come with some of the most competitive rates in the industry, helping you save more.

Fast and Simple Application

With our user-friendly online application, applying for a loan is quick and hassle-free. Receive a decision promptly.

Dedicated Customer Support

Our team of friendly representatives is here to guide you at every stage. We are committed to providing best service.

Top-Rated Service

We’re proud to be highly rated by our customers for service. Your trusts are what drive us forward.

TESTIMONIALS

What Our Customers Are Saying

Read testimonials from our satisfied customers and see how LendXpress has supported them through their financial journeys.

LendXpress provided a seamless loan experience with fast approval and excellent customer support. Their flexible repayment plans made managing my finances easy. Highly recommend their services!

Alex J.

LendXpress delivered exactly what I needed—fast approval, low rates, and flexible repayment options. The support throughout was top-notch. I couldn’t be happier with their service!

Maria G.

I’m so grateful for LendXpress! Their flexible repayment options gave me the breathing room I needed, and the low rates made it affordable. The whole experience was smooth.

Jordan E.

FAQ

Frequently asked questions

We’ve answered a few FAQs to help guide you through our loan process. If you have more questions, feel free to reach out!

How does the loan application process work?

Start by filling out our simple online form. We’ll ask for some basic information to assess your loan options. Once submitted, our team will review and reach out with next steps.

How long does it take to get approved?

We strive to provide fast approvals. Most applicants receive a decision within 24 to 48 hours after submitting their application.

What documents are required to apply?

You’ll need to provide a valid ID, proof of income, and details about your financial situation. In some cases, additional documents may be required, but we’ll guide you through the process.

How do I customize my repayment plan?

Once approved, you can work with our loan specialists to choose repayment terms that fit your budget and financial goals. We offer flexible options to suit your needs.

What happens after I’m approved?

Once approved, your loan agreement is finalized and funds are transferred directly to your account. Most customers receive their funds within one business day.

Are there any fees involved in applying?

No, there are no application fees to get started. We also ensure full transparency, so you won’t encounter any hidden fees along the way.

What if I have bad credit? Can I still apply?

Yes! We work with all credit types, including those with less-than-perfect credit. While credit score may impact the loan terms, we offer options for a wide range of financial profiles.

Can I check my loan status?

Absolutely. You can log into your account at any time to track your application status or contact our support team for updates.

BLOGS & ARTICLES

Our Latest News and Insights

Explore latest news and insights. Get our latest tips to stay smart about your money!

Subscribe for expert advice on managing debt and more.

Subscribe for expert advice on managing debt and more.

Learn how flexible repayment plans can be tailored to suit your financial situation. We break down the key factors to consider.

-

Akshay

Find out why quick loan approvals are essential for both personal and business borrowers, and how they can impact your financial decisions.

-

Akshay

This guide helps you understand the different types of loans available and how to select the best fits for your need.

-

Akshay