Home » Consolidation Loan

Unlock Your Financial Potential with LendXpress Consolidation Loans

Simplify your finances by combining multiple debts into a single, manageable monthly payment. Our consolidation loan solutions are tailored to help you regain control and achieve financial stability.

- Consolidate high-interest debt into one lower-rate payment

- Flexible loan amounts and repayment terms to suit your budget

- Quick, easy, and secure application process with no hidden fees

WHY LendXpress

Why Choose LendXpress for Your Consolidation Loan

Take charge of your debt with the flexibility and ease that LendXpress consolidation loans provide. We’re here to help simplify your payments and reduce your financial burden.

Detailed Financial Review

We evaluate your entire financial situation to create a debt consolidation plan that works best for you, beyond just your credit score.

Custom Loan Solutions

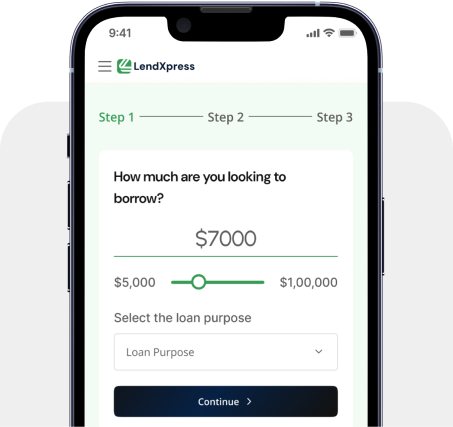

Consolidate debts ranging from $1,000 to $50,000 with terms designed to help you manage and reduce your financial stress.

Lower Rates, Flexible Terms

Choose from 3- or 5-year repayment plans with competitive rates, starting as low as 4.6% APR. Manage your payments easily and confidently.

No Prepayment Penalties

If you’re ready to pay off your loan early, you can do so without any additional fees, giving you full control over your repayment schedule.

HOW IT WORKS

Your Path to Financial Success

Experience a seamless process for obtaining a loan, with personalized support from application to fast approval. Let us help you achieve your financial goals!

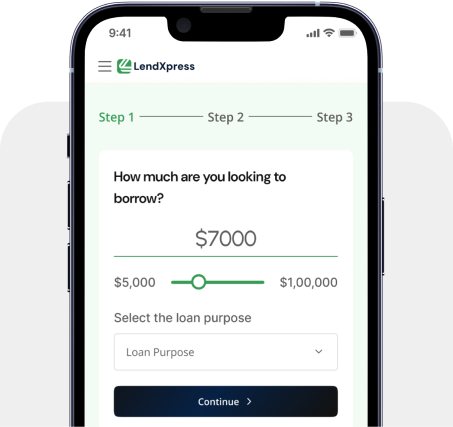

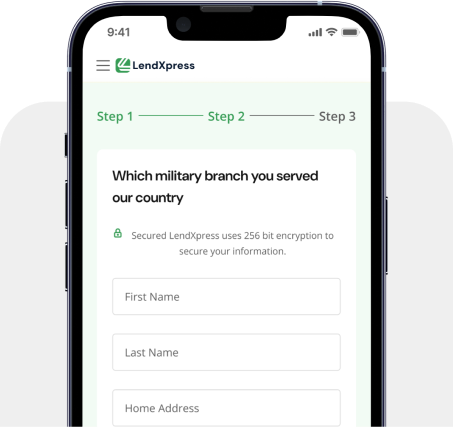

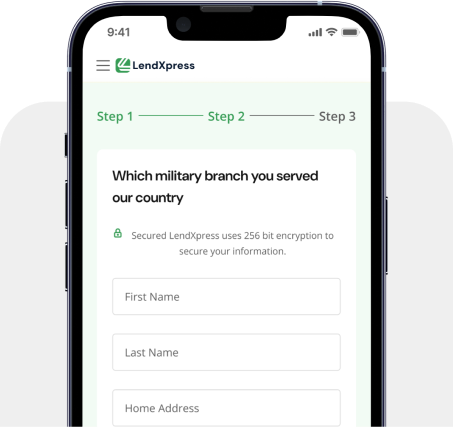

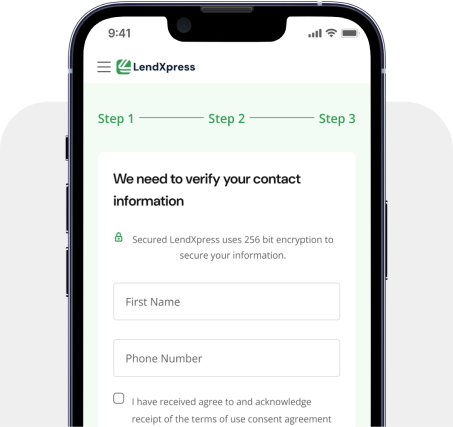

Simple and Secure Application Process

Submit your information through our secure online form, and our loan specialists will connect with you at your convenience. Your details are safe, and we’ll help you take the next steps quickly and securely.

Tailored Debt Consolidation Guidance

Our financial experts work with you to understand your debt situation and offer personalized solutions. We’ll guide you through loan options designed to reduce your debt and simplify your payments.

Fast & Reliable Debt Consolidation Approval

Once approved, we’ll transfer the funds directly to your creditors or your account. Most customers receive approval and funding within one business day, helping you get back on track quickly.

Simple and Secure Application Process

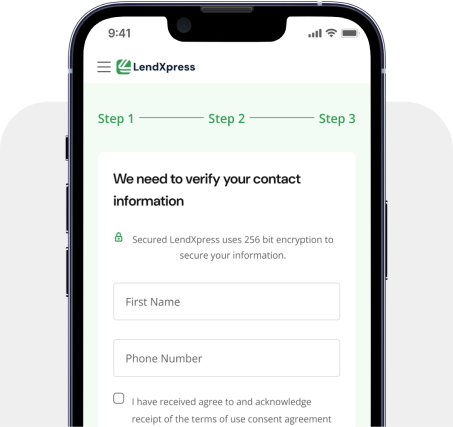

Submit your basic information through our secure form. Let us know the best time for us to reach out, ensuring our loan specialists connect with you at your convenience. your personal details are fully protected.

Personalized Financial Consultation

Talk to a loan specialist about your financial goals and explore loan options, terms, and rates. Get expert guidance on the best products for your needs. If you qualify, move forward with the application for approval.

Fast & Secure Loan Approval Decision

Receive your loan approval decision promptly. If approved, 99% of funds are transferred directly to your account within one business day. Start your journey to financial freedom today with LendXpress!

TESTIMONIALS

What Our Customers Are Saying

Read testimonials from our satisfied customers and see how LendXpress has supported them through their financial journeys.

LendXpress provided a seamless loan experience with fast approval and excellent customer support. Their flexible repayment plans made managing my finances easy. Highly recommend their services!

Alex J.

LendXpress delivered exactly what I needed—fast approval, low rates, and flexible repayment options. The support throughout was top-notch. I couldn’t be happier with their service!

Maria G.

I’m so grateful for LendXpress! Their flexible repayment options gave me the breathing room I needed, and the low rates made it affordable. The whole experience was smooth.

Jordan E.

FAQ

Frequently asked questions

We’ve answered some common questions about debt consolidation loans. For more details, feel free to contact us!

What is a debt consolidation loan?

A consolidation loan allows you to combine multiple debts into one loan with a single monthly payment, often at a lower interest rate, to make managing your finances easier.

How can a consolidation loan help me?

By consolidating high-interest debts, you can lower your monthly payments, reduce your interest charges, and simplify your financial life with one payment.

How long does it take to receive funds?

After approval, funds are usually transferred to your creditors or your account within 1-2 business days.

Can I get a consolidation loan with bad credit?

Yes! We work with all credit profiles to help you find a debt consolidation solution that works for your situation.

Are there any fees for paying off my loan early?

No. We don’t charge prepayment penalties, so you can pay off your consolidation loan early and save on interest.

What are the benefits of a consolidation loan?

You’ll benefit from lower interest rates, a single monthly payment, and a clear path to paying off your debt faster.

What types of debt can I consolidate?

You can consolidate credit card debt, medical bills, personal loans, and other unsecured debts into one easy-to-manage loan.

How much can I borrow with a consolidation loan?

Our consolidation loans range from $1,000 to $50,000, based on your financial needs and qualifications.

BLOGS & ARTICLES

Our Latest News and Insights

Explore latest news and insights. Get our latest tips to stay smart about your money!

Subscribe for expert advice on managing debt and more.

Subscribe for expert advice on managing debt and more.

Learn how flexible repayment plans can be tailored to suit your financial situation. We break down the key factors to consider.

-

Akshay

Find out why quick loan approvals are essential for both personal and business borrowers, and how they can impact your financial decisions.

-

Akshay

This guide helps you understand the different types of loans available and how to select the best fits for your need.

-

Akshay

OTHER LOAN OPTIONS